(Disclaimer: This article is for educational purposes only and should not be considered financial advice. All investment decisions should be made in consultation with a qualified financial professional.)

Have you ever dreamed of making money while you sleep? It’s the ultimate financial goal: creating an income stream that flows into your bank account without you having to trade your time for it. While it may sound like a fantasy, this is the core principle of passive income, and the most time-tested strategy to achieve it is dividend investing.

Forget the complexities of day trading or the risks of speculative ventures. Dividend investing is a straightforward, powerful strategy that allows you to own a piece of the world’s most successful companies and get paid for it. This is your ultimate guide to understanding and starting your journey in 2025.

What Are Dividends? The Superpower of Getting Paid to Own

Imagine you own a tiny fraction of a successful local coffee shop. At the end of each quarter, the owner shares a portion of the profits with you, simply because you are a part-owner. That payment is a dividend.

Now, scale that idea up. When you buy a share of a company like Apple, Coca-Cola, or Johnson & Johnson, you become a part-owner. Because these are mature, profitable businesses, they often don’t need to reinvest every single dollar back into the company. So, they distribute a portion of their profits to their shareholders as a cash payment, or dividend.

This is the superpower of this long-term investing strategy: you make money in two ways.

-

Capital Appreciation: The value of your shares can increase over time.

-

Dividend Payments: You receive regular cash payments, creating a reliable income stream.

This combination is the engine of compounding wealth.

How to Find Great Dividend Investments: The Beginner’s Playbook

While experienced investors might analyze financial statements to find individual high dividend yield stocks (like the “Dividend Aristocrats” who have increased dividends for 25+ consecutive years), there is a much simpler and safer path for beginners.

The Easiest Path: Dividend ETFs An ETF (Exchange-Traded Fund) is a single investment that holds a basket of hundreds or even thousands of different stocks. A dividend ETF specifically focuses on companies that consistently pay dividends. This instantly diversifies your investment portfolio, significantly reducing your risk.

For beginners, starting with a well-regarded, low-cost dividend ETF is the gold standard. Two of the most popular in the United States are:

-

Schwab U.S. Dividend Equity ETF (SCHD): Focuses on high-quality, dividend-paying U.S. stocks with a history of sustainability. It’s a favorite for those seeking both growth and income.

-

Vanguard High Dividend Yield ETF (VYM): Tracks an index of U.S. companies that are forecasted to have above-average dividend yields, making it ideal for investors focused purely on maximizing their passive income stream.

Where to Buy Dividend Stocks and ETFs? Your Brokerage Account

To begin your dividend investing journey, you need a place to buy and hold your investments. This is done through a brokerage account. Opening one is a simple online process, similar to opening a bank account.

Choosing the best brokerage account for beginners often comes down to low fees, an easy-to-use platform, and good customer support. Many modern brokerages offer commission-free trades on stocks and ETFs, making it incredibly affordable to start.

To get started, you can explore platforms like Fidelity, Charles Schwab, or Vanguard. Simply visit their website, follow the steps to open an individual brokerage account, and connect your bank account to fund it. This is your gateway to the stock market.

The Secret Sauce: Automate Your Growth with DRIP

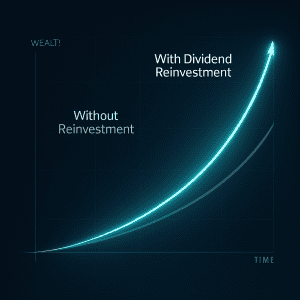

Here is where the magic of compounding truly ignites. Most brokerages offer a feature called a DRIP (Dividend Reinvestment Plan). When you turn this on, instead of receiving your dividend payments as cash, the brokerage automatically uses that money to buy more shares of the same stock or ETF.

Here’s a simple example:

-

You own 100 shares of an ETF that pays a $1 dividend per share.

-

You receive a $100 dividend payment.

-

With DRIP enabled, that $100 is automatically used to buy more shares of the ETF.

-

Now you own more shares, so the next time dividends are paid, you’ll receive an even larger payment, which then buys even more shares.

This creates a powerful, self-fueling snowball of wealth that grows exponentially over time, all without you having to lift a finger.

Your Step-by-Step Action Plan to Start in 2025

-

Choose Your Brokerage: Research beginner-friendly platforms and open your brokerage account.

-

Fund Your Account: Link your bank and transfer the amount you’re comfortable investing.

-

Select Your Investment: For simplicity and diversification, choose a low-cost dividend ETF like SCHD or VYM.

-

Make Your First Purchase: Search for the ETF’s ticker symbol (e.g., “SCHD”) and place your first buy order.

-

Activate DRIP: Go into your account settings and ensure the Dividend Reinvestment Plan is turned on for your new investment.

-

Be Consistent: The final, most important step is to contribute regularly to your account over the long term.

Your Journey to Financial Freedom

Dividend investing isn’t a get-rich-quick scheme; it’s a get-rich-surely strategy. It is a marathon, not a sprint. By starting today, you are planting a financial tree that, with time and consistent nurturing, can grow to provide you with shade and fruit in the form of passive income for years to come, paving your path towards financial freedom.