Your financial future doesn’t have to be a source of anxiety. Whether you dream of early retirement, buying your first home, or simply feeling more in control of your money, a comprehensive financial plan is your roadmap. You don’t need to be a financial whiz or hire an expensive advisor to get started. This 7-step DIY guide will empower you to take charge of your financial destiny, starting today.

Step 1: Define Your Clear Financial Goals (Your North Star)

Before you can create a plan, you need to know where you want to go. Your financial goals are your “why”—they provide the motivation and direction for all your financial decisions.

Be specific. Instead of “save more money,” aim for “save $10,000 for a down payment on a house within the next two years.” Break down long-term goals into smaller, achievable milestones. Consider goals related to:

- Retirement

- Homeownership

- Paying off debt

- Travel

- Education

- Starting a business

Write down your goals and prioritize them. Understanding what’s most important to you will help you allocate your resources effectively.

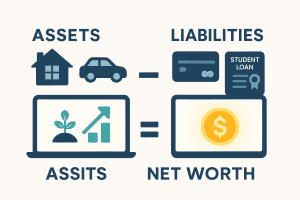

Step 2: Calculate Your Net Worth (Your Starting Point)

Your net worth is a snapshot of your current financial health. It’s the difference between what you own (assets) and what you owe (liabilities).

Assets:

- Cash in checking and savings accounts

- Investment accounts (stocks, bonds, retirement funds)

- Real estate

- Vehicles

- Other valuable possessions

Liabilities:

- Credit card debt

- Student loans

- Mortgage

- Car loans

- Personal loans

Subtract your total liabilities from your total assets. This number is your net worth. Tracking it over time will show you whether you’re moving towards your financial goals. You can use a simple spreadsheet or dedicated financial planning software like Monarch Money or YNAB (You Need A Budget) to help with this calculation.

Step 3: Create a Debt Repayment Plan (Clearing the Path)

High-interest debt can significantly hinder your progress towards your financial goals. Develop a plan to tackle it strategically. Common debt repayment methods include:

- Debt Snowball: Pay the minimum on all debts except the smallest one, which you attack with full force. Once that’s paid off, move to the next smallest, and so on.

- Debt Avalanche: Focus on paying off the debt with the highest interest rate first, while making minimum payments on the others.

Choose the method that best motivates you and create a realistic repayment schedule. Consider exploring options like balance transfers or debt consolidation to potentially lower interest rates.

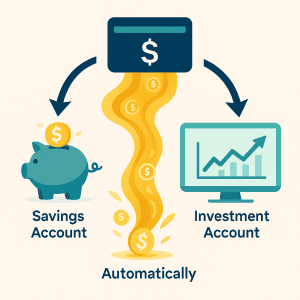

Step 4: Automate Savings and Investments (Building Your Future on Autopilot)

One of the most effective ways to build wealth is to pay yourself first. Automate your savings and investments by setting up recurring transfers from your checking account to your savings and investment accounts.

Determine how much you can realistically save and invest each month based on your income and expenses (which you can track using budgeting apps like YNAB). Even small, consistent contributions can grow significantly over time thanks to the power of compounding. For retirement savings, explore employer-sponsored plans like 401(k)s or consider opening an IRA. For general investing, research different investment strategies that align with your risk tolerance and time horizon.

Step 5: Review Your Insurance Coverage (Protecting Your Assets)

Insurance is a crucial part of a comprehensive financial plan. It protects you and your assets from unexpected events that could derail your progress. Review your coverage for:

- Health insurance

- Auto insurance

- Homeowners or renters insurance

- Life insurance (if you have dependents)

- Disability insurance

Ensure you have adequate coverage to protect against potential financial hardship. Shop around for the best rates and understand your policy deductibles and limits.

Step 6: Plan for Retirement (Securing Your Future)

Retirement may seem far away, but the earlier you start planning, the better. Determine how much you’ll need to live comfortably in retirement and start saving consistently. Utilize tax-advantaged retirement accounts and consider consulting resources on retirement planning to understand different investment options and withdrawal strategies. Even if retirement is decades away, small, regular contributions now can make a significant difference later.

Step 7: Review and Adjust Your Plan Annually (Staying on Track)

Your financial plan is not a static document. Life circumstances change, your goals may evolve, and the economic landscape can shift. It’s essential to review your financial plan at least once a year (or more frequently if major life events occur) and make necessary adjustments.

Track your progress towards your goals, reassess your net worth, review your budget, and ensure your insurance coverage still meets your needs. This annual review will help you stay on track and make informed decisions to secure your financial future.

Take Control of Your Financial Future Today

Creating a financial plan might seem daunting, but by breaking it down into these 7 manageable steps, you can gain clarity, confidence, and control over your financial life. You don’t need to wait for the “perfect” time or a large sum of money to start. The most important step is the first one. Take action today and begin building the foundation for a secure and prosperous financial future.